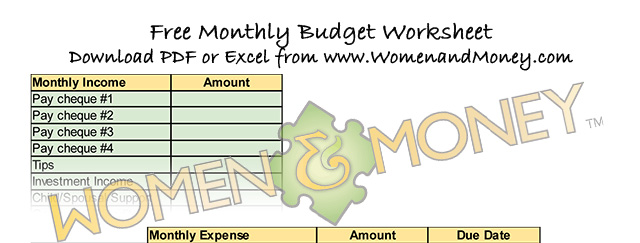

Use our handy Budget Worksheet

Some of you have never made a household budget, some of you may have made one a long time ago and need a refresher to get back on track. So, we are going to walk you through creating a budget. Get out all of your documents, a pencil and a glass of wine or a cup of tea, and follow these steps:

1. Determine your monthly income

2. Determine your fixed expenses (i.e. Rent, Car insurance etc.)

3. Estimate your flexible expenses (i.e. Food, clothing, gifts etc.)

4. Add up Total Monthly Income and Expenses

5. Subtract Monthly Income from Expenses

6. There’s Your Balance

To determine your monthly income, only write down income that is guaranteed to you each month. This includes retirement funds, CPP, support payments or other money you might receive.

Fixed expenses are expenses that don’t change from month to month.

Estimate your flexible expenses – there are expenses you control of each month – for example, entertainment. After filing in this section, you will be able to determine categories you can save on.

Now come some simple math – first add up your total monthly income and expenses.

Subtract your total monthly income from your total monthly expenses to determine your balance.

This balance is what you should be putting away into your savings account each month.